Where is Pocket Option Located?

Pocket Option, a popular trading platform, has gained a significant user base due to its user-friendly interface and versatile trading options. Many traders are curious about where is pocket option located where is pocket option located, as the location of a company often influences its legitimacy, regulatory compliance, and the safety of user funds. In this article, we will explore the location of Pocket Option, its licensing status, and what it means for traders around the world.

The Origin of Pocket Option

Pocket Option was established in 2017 and is operated by Gembell Limited, a company that is based in the state of Saint Vincent and the Grenadines. This offshore location is common among many online trading platforms, as it provides several advantages, including lower regulatory burdens and easier company registration processes. However, it’s essential for traders to understand the implications of trading on a platform registered in an offshore jurisdiction.

Licensing and Regulation

While Pocket Option is registered in Saint Vincent and the Grenadines, it’s important to note that this jurisdiction does not have stringent regulatory frameworks for financial services. As a result, Pocket Option is not regulated by a major financial authority like the UK’s Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC). This lack of regulation can be a concern for traders, as it may impact the security of their funds and their legal recourse in the event of disputes.

Global Reach and Accessibility

Despite its location, Pocket Option has managed to build a global trading community. The platform is accessible to traders from various countries, including those with stringent financial regulations. The user-friendly design and diverse financial instruments make it appealing to both novice and experienced traders alike. Additionally, Pocket Option supports multiple languages, further broadening its reach.

Safety and Security Considerations

When trading with an offshore broker like Pocket Option, safety and security become paramount concerns for traders. The platform employs industry-standard encryption protocols to protect user data and funds. Additionally, traders are advised to use secure passwords, enable two-factor authentication, and be cautious of phishing attempts. Given the absence of strong regulatory oversight, it is crucial for users to take personal responsibility for their trading safety.

Customer Support and User Experience

Pocket Option places a high emphasis on customer support, offering assistance through various channels such as live chat, email, and a comprehensive FAQ section. The platform is designed to provide a seamless user experience, with easy navigation and quick access to trading tools. Feedback from users indicates that the customer support team is responsive and helpful, which can be a comforting factor for traders worried about unresolved issues.

Trading Options Available

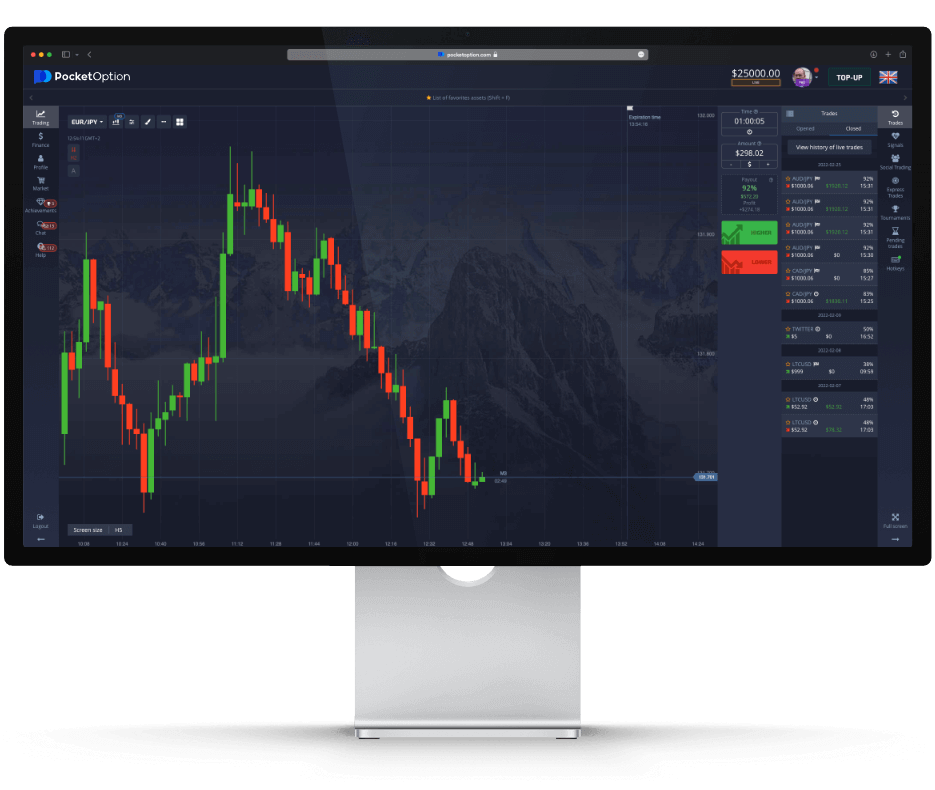

Pocket Option offers a diverse array of trading options, including binary options, digital options, and forex trading. This diversity allows traders to choose the type of trading that best suits their strategies and risk tolerance. The platform also features a demo account, enabling users to practice trading without risking real money, a valuable resource for both beginners and seasoned traders alike.

Conclusion: Is Pocket Option Right for You?

In conclusion, while Pocket Option’s physical location in Saint Vincent and the Grenadines may raise some regulatory questions, its robust trading platform, diverse options, and strong customer support are significant advantages. Traders must weigh the pros and cons of using an offshore broker and consider their individual trading needs and risk tolerance. Conducting thorough research and understanding the implications of trading with platforms like Pocket Option is essential for ensuring a successful trading experience. Ultimately, Pocket Option can be a suitable choice for many traders, but due diligence is key.